Pooled Income Fund

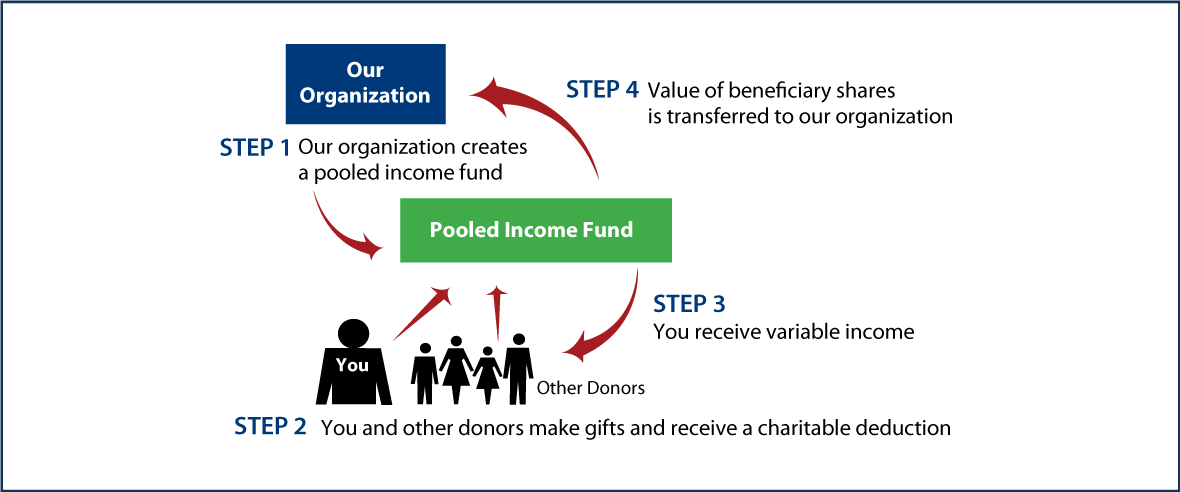

How It Works

- You sign pooled income fund (PIF) agreement and designate the income beneficiaries

- You transfer cash or appreciated securities to trustee and receive an income-tax deduction (your gift will be co-mingled with similar gifts of other donors and invested and managed by a trustee)

- Trustee makes quarterly payments to income beneficiaries for their lifetimes

- Remainder goes to Kent for purposes you specify

Benefits

- You or one or more beneficiaries will receive income annually that varies with the value of the trust each year

- You will receive a federal income-tax deduction for the present value of charity's remainder interest in your portion of the PIF

- You will not be taxed on capital gain when appreciated assets are donated and sold

- Pooled fund remainder will provide generous support for Kent

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Greg Carter

Director of Advancement

860-927-6279

carterg@kent-school.edu

Kent School

1 Macedonia Road, PO Box 2006

Kent, CT 06757

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer